Private Limited Company Characteristics

An LLC is not a corporation under state law. An unlimited company or private unlimited company is a hybrid company incorporated with or without a share capital but where the legal liability of the members or shareholders is not limited.

Characteristics Of A Private Limited Company Strictlylegal

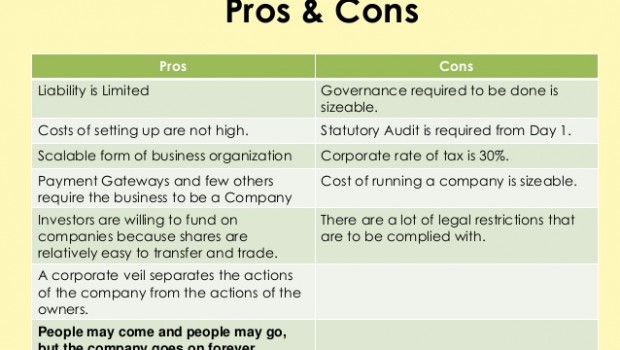

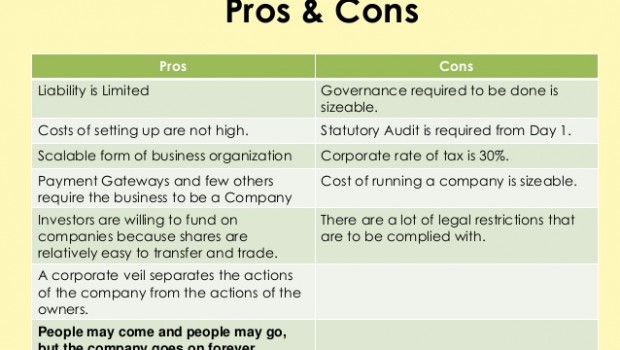

Benefits on taxes taxation.

. In the case of Private Limited Company and LLP the liabilities of the partners would be. Characteristics of a Public Company. The Group invests principally in the industrial office and retail sectors and will also consider other sectors including mixed-use residential hotels healthcare and leisure.

As per the provisions of the Companies Act 2013 to start a public limited company a minimum of 3 directors are required and there is no restriction on the maximum number of directors. It is not always necessary that the name the business owner is looking for will be available as no two companies can have the same name. Mention of Private Limited Company at the end.

In simple words a shareholder of a public limited company isnt. It is a legal form of a company that provides limited liability to its owners in many. Your company will be small if it has any 2 of the following.

A private limited company is common for a new company. However Section 3 of the Companies Act 2013 allows formation of One Person Company also. The 50 or so shareholders that comprise a Private Limited Company must keep their shares and cannot trade them on any stock exchange.

A limited liability company LLC is the US-specific form of a private limited companyIt is a business structure that can combine the pass-through taxation of a partnership or sole proprietorship with the limited liability of a corporation. Characteristics of a Public Limited Company Directors. A private limited company is required to cover three aspects while deciding a name for itself.

That means Private Limited Company or LLP is treated as a different individual in the eyes of law. A private limited company or LTD is a type of privately held small business entity in which owner liability is limited to their shares the firm is limited to having 50 or fewer shareholders. A direct secondary is when a stockholder of a private company sells its stock to a third party in a private transaction.

See Secondary Discounted Cash Flow DCF. The liability of each shareholder is limited. Minimum number of members required for this purpose is seven in the case of a public company and two in the case of a private company.

To both types of business structures tax benefits are given. A private limited company is a company whose shares are not listed on a stock exchange have limited liability and have a separate legal identity from the owners. The investment policy of the Company is to own a diversified portfolio of UK real estate underpinned by good fundamental characteristics.

A turnover of 102 million or less. Activity to be carried out. Private Limited Companys must also pay taxes and insurance for their employees.

The tax benefits would be 30 of the profits. Shareholders in a Private Limited Company are not able to sell or transfer their shares to the general public. A public company sometimes called a publicly traded company or publicly held company is a limited liability business that offers stock bonds or loans to the.

That is its members or shareholders have a joint several and non-limited obligation to meet any insufficiency in the assets of the company to enable settlement. Everything you need to know about the characteristics of companyA company is a voluntary association of persons recognised by law having a distinctive name a common seal formed to carry on business for profit with capital divisible into transferable shares limited liability a corporate body and perpetual succession. A company must be incorporated or registered under the Companies Act.

51 million or less on its balance sheet. A privately held company or private company is a company which does not offer or trade its company stock to the general public on the stock market exchanges but rather the companys stock is offered owned traded exchanged privately or over-the-counterIn the case of a closed corporation there are a relatively small number of shareholders or company members. Because they are not listed on a stock exchange their shares are not traded to the general public.

Discounted cash flow or DCF is a valuation model that projects a companys cash flows out in the future and then calculates the present value of these cash flows to determine.

Public Limited Company Definition Features Advantages Disadvantages

Top 7 Characteristics Of A Private Limited Company In India

The Private Limited Company Registration With Attaining Legality Techno Faq

No comments for "Private Limited Company Characteristics"

Post a Comment